Table of Contents

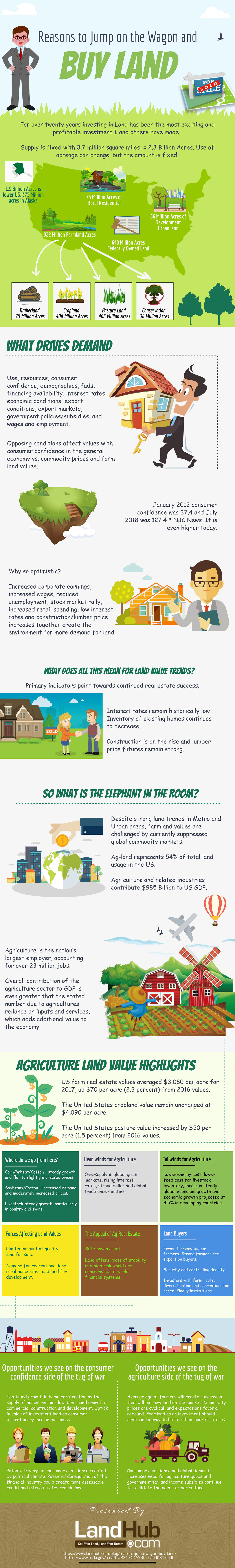

Land has turned out to be one of the most profitable investment options in the US over the past two decades. While the supply is fixed at 2.3 billion acres, the inventory of homes keeps reducing as more and more buyers and investors invest in land.

But is this trend going to continue? Let’s find out below.

Factors Associated with an Increased Demand

There are multiple factors that lead to an increased demand for land in the US. They typically include resources, use, demographics, with the more variating ones being government policies, interest rates, economic conditions, financing availability and more.

Most of these factors have been favorable in recent times, helping boost land prices.

There are currently also a couple factors that are kind of pulling down land prices. They primarily include falling farmland values and a decrease in commodity prices globally.

Consumer Confidence and the Optimism

Consumer confidence is one of the most important factors associated with the demand for land in the US. It has been exceptionally optimistic, as NBC News reported that it reached a level of 127.4 in 2018 from just 37.4 in January 2012.

The reasons for such a high level of optimism is that the interest rates have hit an all-time low, the corporate earnings have been better than expected, the wages have increased considerably, the stock market has been having a bull phase and more.

All these factors have combined to create an optimistic environment for land in the US.

What About the Future Trends?

The main indicators right now suggest that this optimism is going to continue into the future. The interest rates remain at historically low levels, and they might stay that way for a fairly long period of time.

Similarly, the inventory of homes on the market has been reducing steadily, while construction and lumber prices have been increasing.

Understanding the Negative Factors

The only factors negatively affecting the US land market are reducing farmland values, which is due to falling commodity prices. And agricultural land constitutes for about 54% of all the land in the US.

That said, things have been improving for farmland as well. In 2017, the farm real estate values increased by $70 per acre over the previous year. The pasture value increased by 1.5 as well.

And the fact that agricultural land tends to be a much more stable investment option adds to their appeal. Even in times of financial instability and risk, farmland values don’t decrease a lot as agricultural land is a considerably more stable investment option.

Opportunities for the Buyers

With the continued optimism, commercial real estate as an investment still appears attractive in the US. While there can be some political uncertainty affecting the prices, there are many factors suggesting a positive trend such as historically low-interest rates.